Recognizing the importance of a strong employer brand in attracting and retaining talent (Bali & Dixit, 2016), Link Humans has for several years provided its clients insight into how their employer brand is perceived via its Employer Brand Index (EBI). The EBI comprises 16 different areas of employer brand (e.g., Diversity & Inclusion), which we call attributes. Taking both the sentiment surrounding each of these attributes and the volume of relative commentary, a score ranging from 1 to 10 is produced, with scores closer to 10 signaling a stronger, more positively perceived employer brand.

Given the complexity and multifaceted nature of employer brand, it can be a difficult task identifying where to allocate resources for improvement, especially if certain attributes are more amenable to change than others. To better guide our clients in their efforts to manage their employer brand, we hoped to establish which areas tended to be more or less stable in the sentiment and relative discussion surrounding them over the past year. Additionally, we also considered a recurring query among our clients throughout the year regarding the discussion around remote work and its impact on employer brand.

To that end, we identified which attributes experienced the largest and smallest changes in score and discussion surrounding them between Q4 2022 and Q3 2023. Moreover, we assessed to what extent mentions of remote work and related terms were present quarter-to-quarter for our recurring clients. The resultant insights may thus help elucidate which areas of employer brand may be more or less challenging to influence in the coming year.

Score Stability

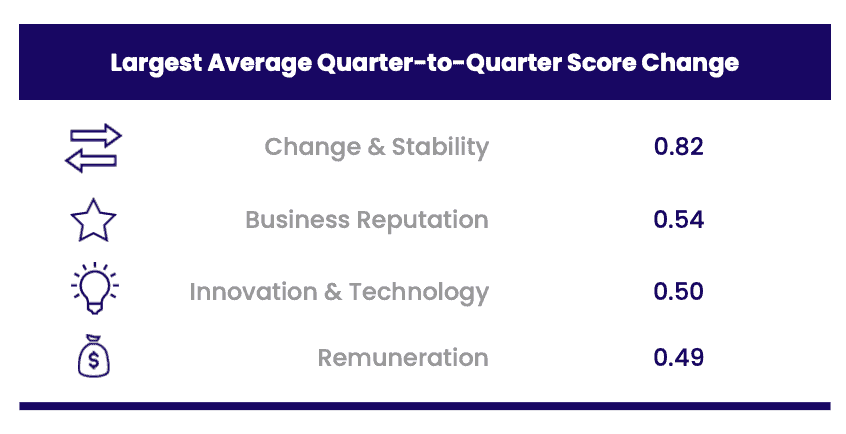

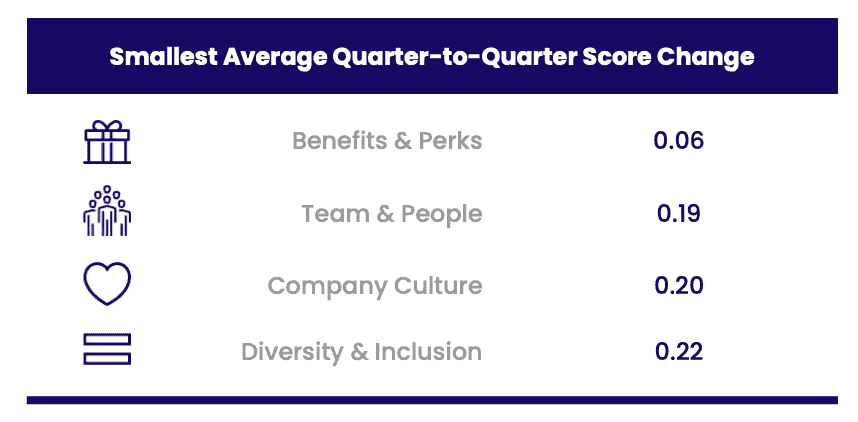

In terms of score stability, we examined the average quarter-to-quarter score change of each attribute. Our findings indicate that across Q4 2022 to Q3 2023, Benefits & Perks tended to experience the least amount of score change quarter-to-quarter, whereas Change & Stability experienced the greatest amount of score change. In other words, there was greater stability in the proportion of positive commentary surrounding Benefits & Perks (along with Team & People, Company Culture, and Diversity & Inclusion) and less in that around Change & Stability (along with Business Reputation, Innovation & Technology, Remuneration).

Minimal changes quarter-to-quarter imply that it may be more difficult to engender immediate score changes for these attributes, as the proportions of positive and negative online commentary around them tend to be more stable. We posit that attributes with smaller average quarter-to-quarter are those generally more resilient to external factors and which are more contingent on internal organizational change. Company Culture, for example, is a notoriously difficult area for organizational development (e.g., Alvesson, M., & Sveningsson, 2015), such that large short-term fluctuations in its perception would be unexpected. Likewise, the benefits offered and advertised by employers are often part of more long-term organizational planning, such that they tend to be more stable over longer stretches of time.

In contrast, attributes with larger average quarter-to-quarter score changes experienced greater fluctuations in the relative proportions of positive and negative commentary about them. Change & Stability, for example, experienced, on average, more dramatic change in score between quarters, resulting from hiring cycles and waves of talent beginning new positions during the year. As a result, whereas changing perceptions of attributes like Company Culture and Diversity & Inclusion may depend more on internal change, attributes such as Business Reputation and Innovation & Technology may be more readily influenced by external communication.

Share of Voice Stability

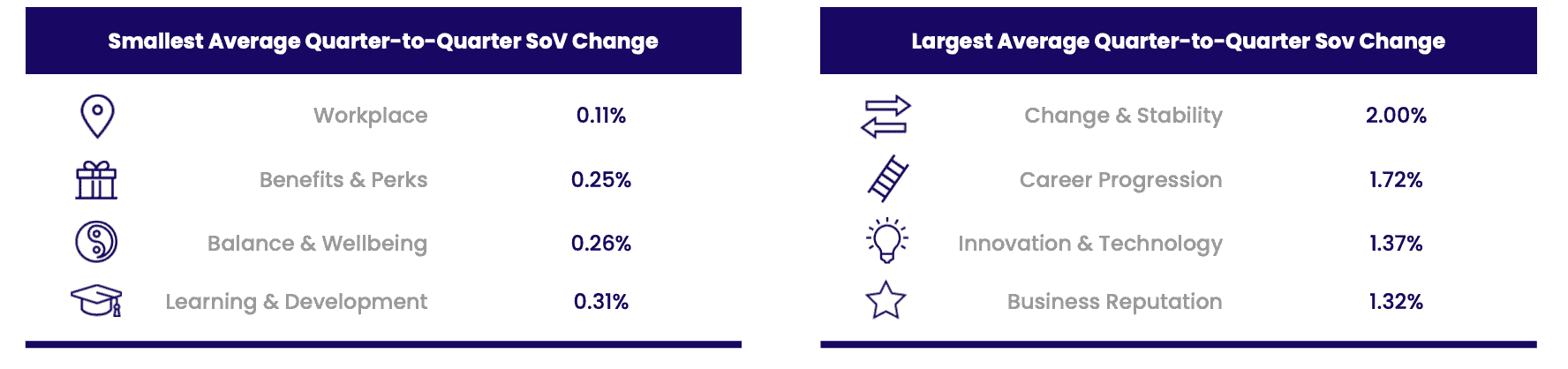

In addition to score changes, we also examined changes in the relative proportions of commentary about each attribute (i.e., share of voice). Our conceptualization of share of voice (SoV) includes quantifying the percentage of data we gathered for a company that refers to one attribute relative to the others. For example, out of 10,000 data points for a company, 1,000 related to Remuneration would be represented by a SoV of 10%.

When collating our data quarter-by-quarter from Q4 2022 to Q3 2023, we found that Workplace, Benefits & Perks, Balance & Wellbeing, and Learning & Development tended to have the most stable share of voice for companies on average. These areas of employer brand were consistent then in how much they were discussed relative to other attributes. In contrast, Change & Stability, Career Progression, Innovation & Technology, and Business Reputation experienced more significant fluctuations in the percentage of commentary surrounding them quarter to quarter. Whereas the factors underlying areas such as Workplace and Balance & Wellbeing may be more consistent over more extended periods of time, ones like Innovation & Technology and Change & Stability may be more susceptible to punctual changes, such as company award wins or waves of hiring, thus amplifying discussion during the pertinent quarters.

Topic in Focus — Remote Work

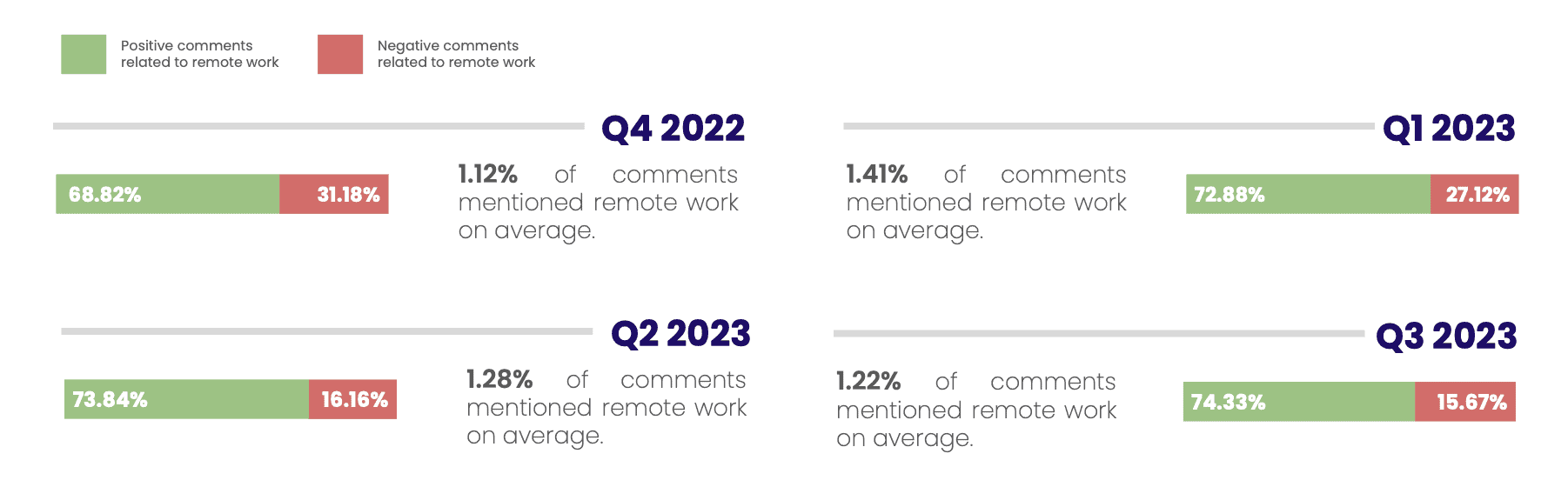

As perhaps the most frequently queried topic by our clients during 2023, remote work–along with its related terms (e.g., work-from-home, return-to-office, teleworking)–was also examined for its potential impact on employer brand. For our recurring clients across Q4 2022 to Q3 2023, comments mentioning remote work and its related terms appeared to comprise on average a small percentage of the total collected comments. The average percentage of total comments relating to this topic for the year ranged from as low as 0.68% to 1.98%. Broken down by quarter, the average percentage across our clients together was scarcely above 1%, with the highest percentage found in Q1 2023 at 1.41%.

We also observed that of the comments pertaining to remote work and related terms, the majority tended, on average, to express positive sentiment. This trend held client-by-client as well, with no one experiencing a majority of negative comments related to remote working. Given how relatively few comments mentioned this topic client-by-client, we concluded it to impact employer brand on average very minimally between Q4 2024 and Q3 2023 across the platforms we analyze. From our analysis, the estimated impact of this topic on EBI score ranged from as low as roughly 0.05 to 0.13; that is, discussion around remote work increased the EBI score for clients anywhere between 0.05 to 0.13 points on average. Our data reflect then that remote work comprised, on average, only a small portion of commentary for clients this year, suggesting that the majority of online discussion is more focused on other topics related to employer brand (e.g., Management & Organization, average 10.80% share of voice). In the context of the total online conversation about our clients, discussion related to remote work and return-to-office mandates was thus, on average, marginally impactful to their employer brand.

Conclusion

Using a year’s worth of data from companies we analyzed, it was possible to identify which attributes experienced the largest and smallest changes on average quarter-to-quarter, both in terms of score and share of voice. Understanding these fluctuations provides useful information in determining where discussion and perceptions are more consistent over time versus where they are more variable. Observing the marginal change in score for Benefits & Perks quarter-to-quarter, for example, highlights how changes in perception of that attribute tended to be minimal across quarters. Monitoring Change & Stability, Business Reputation, and Innovation & Technology may be of particular value, as they experienced the greatest fluctuations in both score and share of voice. Additionally, we also observed that discussion around remote work comprised only a small portion of the overall commentary for clients, such that its impact on the overall employer brand was often negligible. Taken together, our examination provides additional context for where companies should focus their efforts for the greatest impact on their employer brand.

By Christopher del Rosso, Lead Data Analyst at Link Humans. Learn more about what the Employer Brand Index can do for your organization’s reputation as an employer.

References

Alvesson, M., & Sveningsson, S. (2015). Changing organizational culture: Cultural change work in progress. Routledge.

Bali, M., & Dixit, S. (2016). Employer brand building for effective talent management. International Journal of Applied Sciences and Management, 2(1), 183-191.

- Tagged With:

- Christopher del Rosso

- Employer brand index

- Remote

- Research

STAY CONNECTED.

DATA-DRIVEN EMPLOYER

BRAND INSIGHTS.

Our newsletter is exclusively curated by our CEO, Jörgen Sundberg, for leaders who make decisions about talent. Subscribe for updates on The Employer Branding Podcast, new articles, eBooks, research and events we’re working on.